If you have a Discover Checking Account, check your emails! A new promotion is going to run for the whole of October and November in 2015 that gets you double the debit rewards. Regularly you get 10c in rewards for every purchase or bill pay or check. During this promotion, you will earn 20c per transaction. There is a maximum of 100 transactions per month that will earn rewards (max $20 per month). For transactions 101 and later, you will earn the standard 10c.

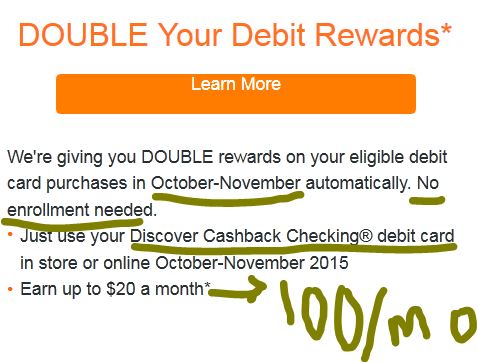

A screenshot of the relevant part from that email can be found right below, with the important points highlighted:

I don’t know if every customer gets it or it is a targeted offer, so that’s where the YMMV comes from…

Strategy Session

Strategically, this means that paying with the Discover Checking card may earn you more points than paying with your regular credit card. If you get 1% credit card rewards, anything under $20, gets you a higher percentage with this offer. For transactions that earn 2% credit card rewards, anything under $10, gets you a higher percentage with this. For the rotating 5% transactions that many credit cards offer, anything under $4 gets you a higher percentage with this.

The above if you take your Discover Cashback as cold hard cash. If you instead prefer to take advantage of their many pre-discounted gift cards, then the Discover Checking offer “wins” even more transactions. That’s because $20 in Cashback gets you a $25 Gift Card (of a handful of other merchants). That’s a 25% bonus, so you have to recalculate the amounts in the first paragraph by adding an extra 25%.

So for 1% credit card rewards, the cut-off point for the Discover Checking would become $25, because your 20c in Cashback would eventually “translate” to a 25c contribution towards a gift card. Same 25% more math with the other percentages.

One thing to note obviously is that paying with a checking account means that the money is out of your pocket/account immediately, while paying with a credit card means you’ll pay for them at some point later in the future. So that’s another trade off to consider.

LATEST COMMENTS