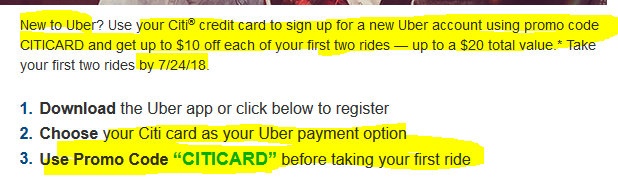

The credit card company bromance with Uber continues with another offer, this one from Citibank. If you sign-up for a new Uber account (not existing customers), and use your Citibank credit card when prompted for a credit card, and use promo code CITICARD, you will receive $10 off each one of your first two riders with Uber. Terms and conditions apply as usual.

LATEST COMMENTS