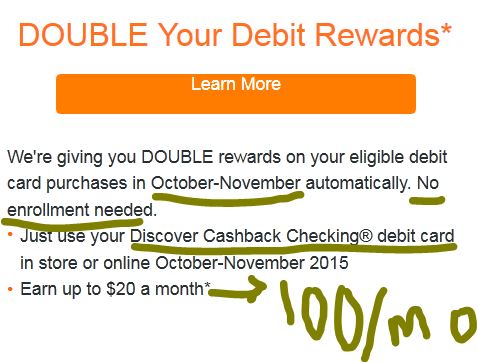

NOTE: This is YMMV because I don’t know how many card variations and card holders are eligible for this.

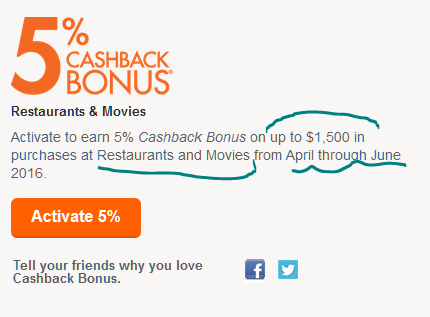

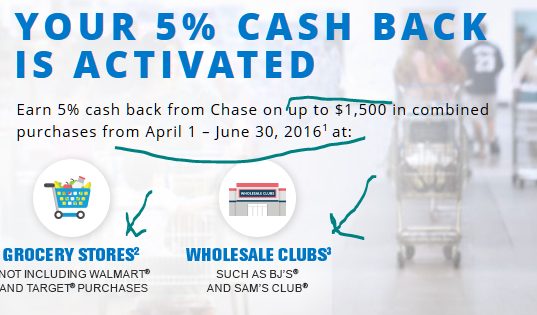

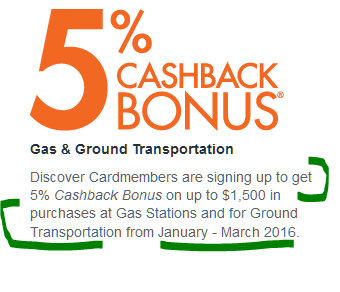

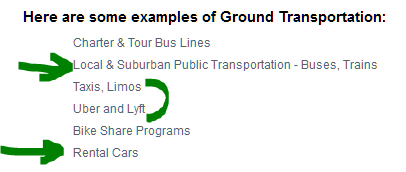

Bank Of America has expanded the cashback benefits for their BankAmericard Cash Rewards Visa Signature credit card. You can now earn 2% cashback at Wholesale Clubs. This is in addition to their existing rewards which are 3% gas, 2% grocery stores. The bonus categories have a quarterly cap of $2500 in combined bonus category purchases, so if you had already been blowing the ceiling of these, you may have to readjust your rewards strategy with other cards or combine the various quarterly offers by Chase or Citibank and Discover.

LATEST COMMENTS