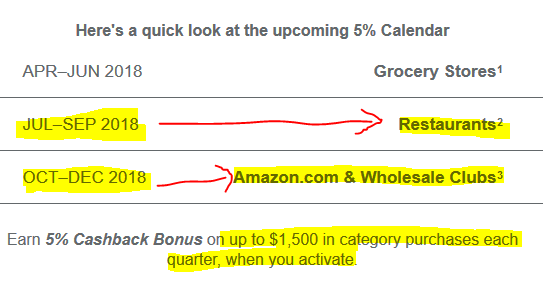

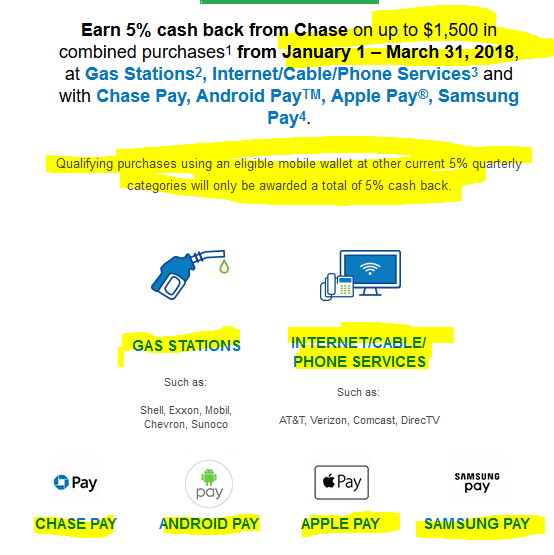

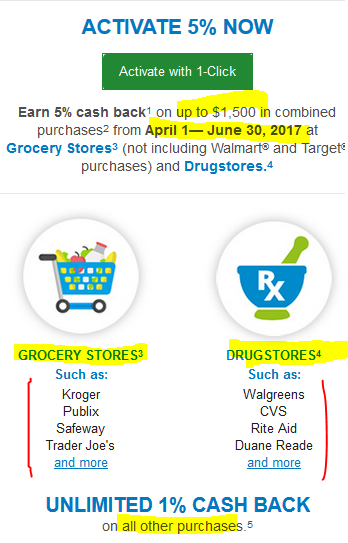

Another quarter is almost over, so the time is right to plan ahead for your Q3 5% cashback bonus promotions for your various credit cards. If you are a Chase Freedom cardholder, check your account online or your email inbox or the Chase app or ChasePAY mobile wallet. You can now activate the Q3 offers!

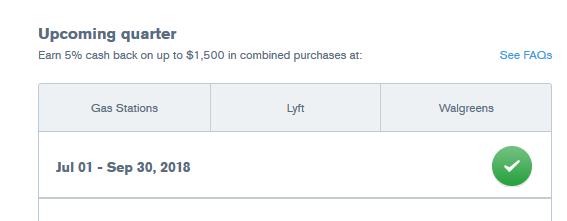

There is a versatile trio of categories that can earn a 5% bonus up to $1500 in purchases between July 1st and September 30 in 2018. With gas prices going up, that extra 5% from gas stations is a nice silver lining. With stress increasing, that 5% from Walgreens can help too. Or if you don’t want to drive or need select lifts to different places, and you are not a fan of Uber, fear not. Lyft is also participating in the 5% promotions of Q3 of 2018.

As usual, the $1500 limit is per credit card, not per account holder, so if you have more than one Chase Freedom credit card, plan ahead so you can split your purchase between them to maximize your bonus cashback.

Every penny counts 🙂

LATEST COMMENTS